Excitement About Personal Loans copyright

Excitement About Personal Loans copyright

Blog Article

4 Easy Facts About Personal Loans copyright Described

Table of ContentsFacts About Personal Loans copyright UncoveredHow Personal Loans copyright can Save You Time, Stress, and Money.Personal Loans copyright Things To Know Before You BuyExamine This Report on Personal Loans copyrightWhat Does Personal Loans copyright Do?

For some lenders, you can inspect your eligibility for a personal funding through a pre-qualification process, which will certainly show you what you may receive without denting your credit report rating. To ensure you never miss a lending payment, take into consideration setting up autopay if your loan provider uses it. In many cases, you might also get a rates of interest discount for doing so.This includes:: You'll need to confirm you have a job with a constant earnings so that you can repay a car loan. You could additionally need current income tax return if you've lately transformed tasks or don't have access to your pay stubs.: A loan provider is going to inquire about where you live, just how much you desire to obtain, what you're planning to make use of the money for, and various other details.

The smart Trick of Personal Loans copyright That Nobody is Talking About

Nevertheless, a reasonable or negative credit rating rating may restrict your options. Individual fundings also have a few fees that you need to be prepared to pay, including an origination charge, which is made use of to cover the expense of refining your car loan. Some lenders will certainly let you pre-qualify for a loan before submitting an actual application.

A pre-qualification can assist you weed out lending institutions that will not give you a funding, however not all lenders supply this option. You can contrast as many lending institutions as you 'd like via pre-qualification, that way you just have to complete a real application with the lending institution that's most likely going to authorize you for a personal lending.

The higher your credit report, the most likely you are to qualify for the most affordable passion rate provided. The reduced your score, the more difficult it'll be for you to get a finance, and even if you do, you could finish up with a rate of interest on the higher end of what's offered.

How Personal Loans copyright can Save You Time, Stress, and Money.

Lots of loan providers offer you the alternative to establish autopay and, in many cases, supply a rates of interest price cut for doing so - Personal Loans copyright. Autopay lets you establish it and forget it so you never need to worry concerning missing out on a finance repayment. Settlement history is the biggest factor when computing your credit report score, and dropping behind on financing repayments can negatively impact your rating.

The customer does not need to report the quantity received on the financing when declaring taxes. If the funding is forgiven, it is thought about a canceled debt and can be tired. Investopedia commissioned a nationwide survey of 962 U.S. grownups between Aug. 14, 2023, to Sept. 15, 2023, who had obtained an individual financing to discover exactly how they used their loan profits and how they could use future personal fundings.

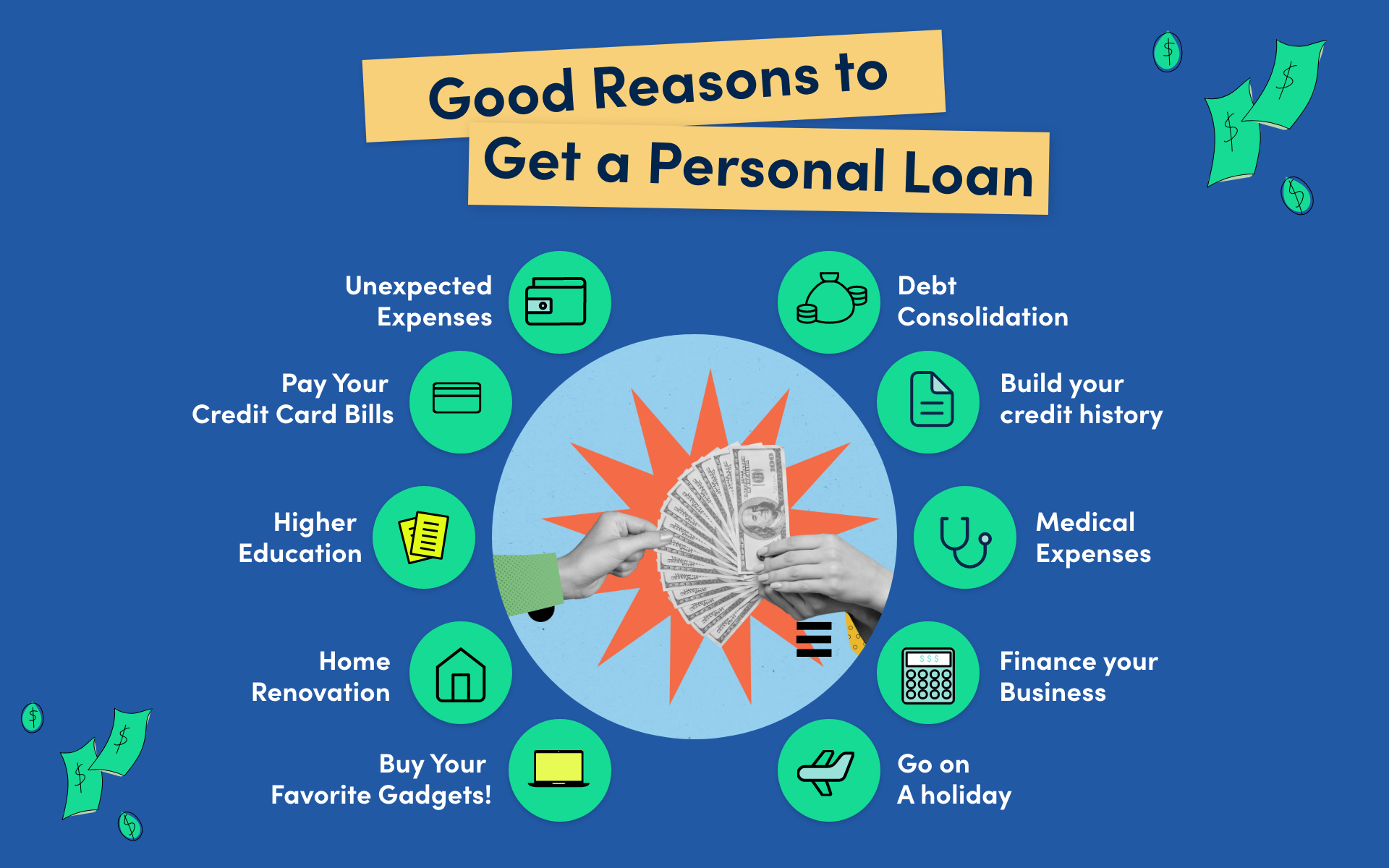

Both personal financings and bank card are two options to borrow cash in advance, but they have various purposes. Consider what you need the cash for prior to you select your repayment alternative. There's no incorrect selection, but one can be a lot more expensive than the various other, depending on your needs.

They aren't for everyone. If you don't have terrific debt, you may need to obtain the aid of a co-signer who consents to your lending terms together with you, taking on the lawful responsibility to pay for the financial debt if you're unable to. If you do not have a co-signer, you might get approved for an individual funding with negative or fair credit score, yet you may not have as several alternatives contrasted to a person with excellent or outstanding debt.

The Facts About Personal Loans copyright Revealed

A credit rating of 760 and up (exceptional) is more probable to get you the lowest rate of interest offered for your car loan. Borrowers with credit report of 560 or below are more most likely to have problem getting far better loan terms. That's because with a lower credit rating, the rate of interest has a tendency to be expensive to make a personal car loan a viable loaning option.

Some aspects bring even more weight than others. 35% of a FICO score (the kind made use of by 90% of the lenders in the country) is based on your settlement history. Lenders wish to make certain you can manage fundings responsibly and will certainly look at your past behaviour to get a concept of how liable you'll remain in the future.

In order to keep that part of your rating high, make all your payments on time. Can be found in 2nd is the quantity of credit card debt exceptional, loved one to your credit score limits. That accounts for 30% see this of your credit history and is understood in the market as the debt application ratio.

The reduced that proportion the better. The length of your credit report, the kind of credit score you have and the variety of new credit report applications you have lately completed are the various other elements that establish your credit history. Beyond your credit report, loan providers look at your earnings, work background, liquid possessions and the quantity of overall financial obligation you have.

The Ultimate Guide To Personal Loans copyright

The higher your revenue and possessions and the lower your other debt, This Site the much better you look in their eyes. Having an excellent credit history when obtaining an individual funding is essential. It not only identifies if you'll get approved but just how much rate of interest you'll pay over the see page life of the lending.

Report this page